1. Saving Doesn’t Cut it Anymore

The concept of saving money in a bank account and expecting any worthwhile return is a thing of the past.

With interest rates loitering at the sub 1% zone since the financial crisis, the truth is low growth and low interest rates are here to stay.

The search of better ways to make your money work for you has never been more relevant. Here are some figures to help validate that point – if you had £10,000 left in cash since the interest rates first went to 0.5% your money would be worth just £10,197 today.

However, if you had placed that money into an average UK equity income fund, it would now be worth £18,203.

2. The Risk Factor

Most saving accounts are very similar in the benefits you receive. There is not much you can do to earn extra interest on your savings. If you want to receive a higher return on your money, you will need to take on greater risk.

There has to be a measured approach to financial risk however. If you cannot afford to lose money, increasing the risk factor of your investment strategy is probably a bad idea.

However, if you can afford to risk a portion of your money, owning a portfolio of investments will give your money increased potential for better income returns.

3. Capital Protection

Upping the risk factor does not mean you are endangering your finances. Protecting your capital is an essential part of any fund manager’s role.

When a fund sacrifices capital in exchange for income, there will come a time when the dividend returns cannot be sustained. This is bad investment practice.

An example can be found in the technology boom of the late 90s. Many income fund managers invested wisely and avoided the speculative technology companies. During the boom, these funds did lag behind the stock market due to the bullish nature of the tech sector.

However, after the crash these same funds were shielded from much of the fallout, and continued to perform well.

4. The Power of Compounding

Equity income has endured as a viable investment method; the power of compounding providing the ongoing attraction.

What this basically means is that your earning potential is increased as you earn on returns already made.

In fact, reinvesting income is one of the biggest determinants of returns over time.

According to Barclays, a £100 worth of gilts bought in 1899 would be worth just £1 today in real terms if you hadn’t reinvested the income. With reinvestment the value would be £427 in today’s terms.

A more dramatic outcome can be seen in the reinvestment of equities. If you invested £100 in the UK stock market in 1899, without reinvestment it would only be worth £160 in real terms today.

However, by reinvesting the dividends on that initial investment, your assets would be worth an incredible £22,239 in today’s terms.

In short, investment income reinvested over time escalates your potential returns over most other available forms of investment strategy.

5. Income-Based Funds = Lower volatility

When compared to general investing in the equity markets, income-based funds provide a greater level of stability. Income funds can also act as a prop to performance when equity markets are in the doldrums.

The reason for this is that many high-yielding stocks, i.e. those shares that fund managers hold on to rather than trade frequently, are defensive in their nature.

A long-standing company that is known for paying good dividends communicates a strong financial position, and therefore a more stable share price.

Overall, this helps give income-based investing a total return that is less volatile than that of the equity market in general.

6. Investment Strategies

Companies that have a strong and stable financial forecast will attract more investors – this in turn sees the share prices go up while the dividend yield is reduced.

It is at this point that an equity income manager will sell. The shares have run their course and it is time to invest in the next high-yielding opportunity.

The strategy that an equity income manager should take, is to buy shares when they are cheap based on the expectation the company will see growth, and then sell the shares when interest peaks and they are more expensive.

Successful investing of this nature will reap great returns over the long term.

7. Importance of Capital Growth

The above being said, it is equally important to allow capital to grow when and where it is appropriate.

Many income fund managers aim to identify value in areas other investors have overlooked. Investors will then remain in that sector for as long as yields are good.

The tobacco sector is one such example of a sector where trading was experiencing a lull. Those income managers that invested at the turn of the century saw massive returns.

Between 2000 and 2011 British American Tobacco’s share price surged by more than 780%. An income-based fund with dividends reinvested would have seen a total return of 1,529%.

8. Dividend growth

For investors looking for a long and happy retirement, dividend growth is a vital part of retirement planning and the pursuit of a sustainable ongoing income.

Unsurprisingly, income-based funds look to prioritize dividend growth as part of their investment strategy.

Here is an example of dividend growth to high light the impact it can have on returns.

A soon to retiree invests £20,000 equally across two funds that are yielding 5% from the start. This means both funds provide a starting income of £1,000 per year each.

The first fund (A) increases its payouts by just 5% per year, while fund (B) sees its dividend growth increase to 10% payouts per year.

After 15 years of investment, Fund (B) would be providing an annual dividend rate of £4,180, while the Fund (A) would provide less than half that, at only £2,080 per year.

9. Inflation Protection

If your capital doesn’t keep up with inflation you will see the real term value of your capital become eroded.

For example, if inflation is running at 3%, and you are a basic-rate taxpayer at the 20% payment level, you would need to achieve a return of 3.75% on a taxable savings account just to break even.

Taking that further, if you pay tax in the 40% threshold, you would need a 5% return in order to keep pace with inflation.

As good performing dividend-paying shares offer a growing income plus the potential for capital growth, an investment of this type will increase your chances of netting an inflation-beating return.

10. Superior performance

Investing using income as a guide to share selection almost invariably produces long-term out-performance.

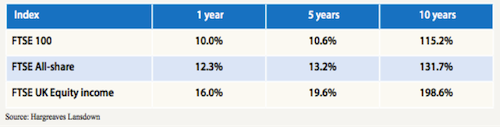

The table below shows total returns from the FTSE 100 and the FTSE All- Share indices compared with the FTSE UK Equity Income index.

Over one, five and ten-year periods, stocks designed to generate an income have outperformed their many alternatives.